Importance of Credit Cards

If you do not own a credit card or revolving account, what you read below may be the most important thing you read to help raise your credit scores.

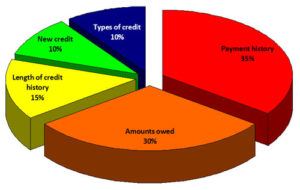

We recommend that you have at least two to three open and active credit card or revolving accounts. Credit Cards are more important to your credit score than any other type of loan, this is because revolving accounts make up 30% of your overall credit score of the FICO scoring model. (See below) This means if you do not have a credit card, you are only scoring in 70% of the FICO model. This is like going to a pizza parlor and ordering a pizza and two slices are missing! You’ll probably send the pizza back and ask for the whole pie.

The ‘Amounts Owed’ section is for scoring the utilization on your credit card or revolving accounts.

The easiest way to build revolving credit when you have bad credit is with a secured credit card. A secured credit card is a type of credit card secured by a deposit account owned by the cardholder. Typically the cardholder needs to put down a minimum of $200 – $500 to secure the line of credit. This deposit is held in a special savings account. Credit card issuers offer this because they have noticed that delinquencies were notably reduced when the customer perceives something to lose if the balance is not repaid. This is NOT a prepaid card, prepaid cards do not report to the three bureaus.

The cardholder of a secured credit card is still expected to make regular payments, as with a regular credit card, but should they default on a payment, the card issuer has the option of recovering the cost of the purchases paid to the merchants out of the deposit. The advantage of the secured card for an individual with negative or no credit history is that the credit card companies report regularly to the three major credit bureaus. This allows for building of positive credit history.

The credit card companies will charge annual fees, setup fees, and sometimes monthly fees for their secured cards. These fees as well as other terms and conditions will be explained in the company’s terms and conditions that are signed upon acquiring the card.

Once you get the secured credit card, you will want to spend minimally on the card each month and pay it down to a small balance of $5 to $10. Try not to go over 20% of the limit at any given time. It is best to use the secured credit card for necessity items such as groceries or gas. This will show activity on the card as well as keeping it at a low balance to help maximize your score. The complete score benefits of the card may take 60 to 90 days to see all of the positive benefit. Many consumers will see a positive impact on their scores as soon as the card reports.

Elevatemyscores.com have the following offices:

Houston Location:

10101 Southwest Fwy

#400A

Houston, TX 77074

(281) 819.6006

Austin Location:

106 East Sixth Street

Suite 900

Austin TX 78701

(512) 807.6006

Yes! Credit cards remain one of the best methods to improve your credit rating. Providing you keep on top of the monthly repayments this still remains one of the easiest strategies to use to improve your credit score.

What I found is ideally and I agree completely, cards should carry a balance that’s less than 30 percent of their individual credit limit, but credit agencies also consider your total pooled credit resources, so even smaller balances can be a potential negative. Keep an eye on what you owe, and strive to pay things in a timely fashion. That’s all the more difficult if you’ve got lots and lots of cards active at the same time.